All Categories

Featured

Table of Contents

The plan acquires value according to a taken care of routine, and there are less fees than an IUL plan. A variable plan's cash worth might depend on the efficiency of certain stocks or other protections, and your costs can also alter.

An indexed global life insurance policy policy includes a survivor benefit, as well as an element that is connected to a stock market index. The money worth development depends upon the performance of that index. These policies use higher possible returns than various other types of life insurance, along with greater dangers and added costs.

A 401(k) has even more financial investment alternatives to select from and may feature an employer suit. On the various other hand, an IUL comes with a death advantage and an extra cash worth that the insurance policy holder can borrow against. They likewise come with high costs and charges, and unlike a 401(k), they can be terminated if the insured quits paying right into them.

Where can I find Iul Insurance?

Nonetheless, these plans can be much more complicated contrasted to various other sorts of life insurance coverage, and they aren't always right for every single investor. Speaking with an experienced life insurance coverage agent or broker can aid you decide if indexed universal life insurance policy is a good suitable for you. Investopedia does not provide tax obligation, investment, or financial services and guidance.

Your current browser could restrict that experience. You might be utilizing an old internet browser that's unsupported, or setups within your web browser that are not compatible with our website.

Is Indexed Universal Life Growth Strategy worth it?

Currently using an updated browser and still having difficulty? If you're browsing for lifetime insurance coverage, indexed universal life insurance coverage is one alternative you might want to think about. Like other long-term life insurance policy products, these plans permit you to construct cash value you can tap throughout your lifetime.

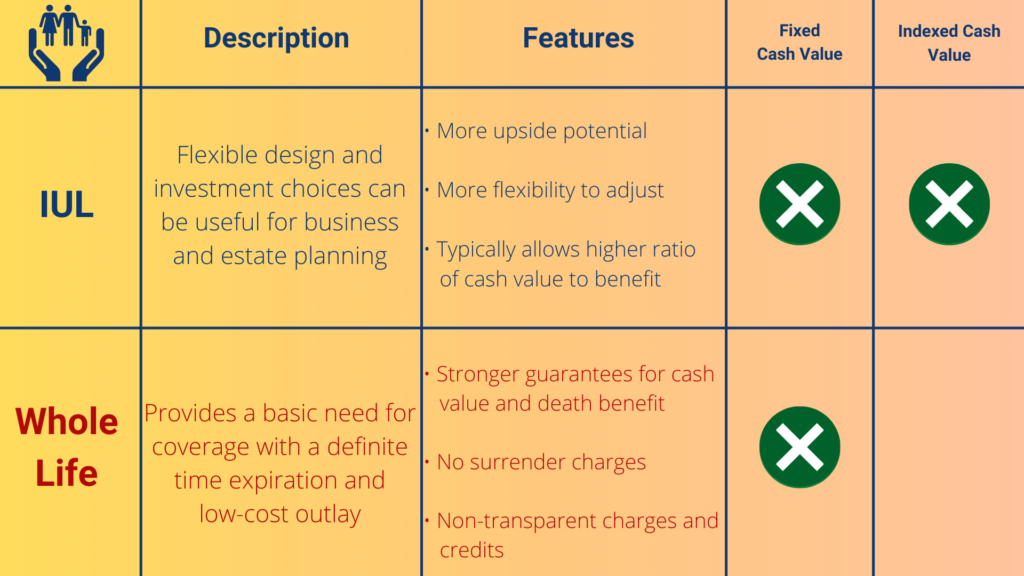

That implies you have a lot more long-lasting development possibility than an entire life policy, which provides a fixed price of return. Typically, IUL policies stop you from experiencing losses in years when the index loses value.

Nonetheless, recognize the benefits and drawbacks of this item to figure out whether it lines up with your economic objectives. As long as you pay the premiums, the plan stays effective for your whole life. You can build up cash money worth you can use throughout your life time for numerous economic demands. You can readjust your premiums and fatality advantage if your circumstances transform.

Who has the best customer service for Iul Tax Benefits?

Irreversible life insurance policy policies usually have greater preliminary premiums than term insurance coverage, so it may not be the ideal selection if you're on a limited budget. IUL vs whole life. The cap on interest debts can restrict the upside possibility in years when the supply market executes well. Your plan can lapse if you take out also large of a withdrawal or policy funding

With the possibility for more robust returns and flexible payments, indexed universal life insurance may be an option you want to consider., who can examine your individual scenario and offer personalized insight.

Suitable for ages 35-55.: Offers adaptable coverage with modest cash value in years 15-30. Some points customers need to take into consideration: In exchange for the death benefit, life insurance policy products charge fees such as death and expenditure danger fees and abandonment charges.

Plan financings and withdrawals might create a damaging tax outcome in the event of lapse or policy surrender, and will minimize both the abandonment value and fatality advantage. Clients ought to consult their tax obligation consultant when thinking about taking a policy car loan.

Who are the cheapest Iul Investment providers?

Minnesota Life Insurance Coverage Firm and Securian Life Insurance coverage Business are subsidiaries of Securian Financial Group, Inc.

Why do I need Iul Cash Value?

IUL can be utilized to conserve for future demands and offer you with a home funding or a safe and secure retirement planning vehicle. IUL gives you cash value development in your lifetime with stock market index-linked financial investments yet with capital defense for the rest of your life.

To understand IUL, we initially require to simplify into its core parts: the money worth element the survivor benefit and the cash worth. The survivor benefit is the quantity of money paid to the insurance holder's beneficiaries upon their death. The policy's cash-in value, on the other hand, is an investment element that expands gradually.

What is Indexed Universal Life For Wealth Building?

Whilst policy withdrawals are valuable, it is crucial to check the plan's efficiency to guarantee it can maintain those withdrawals. Some insurers likewise limit the quantity you can withdraw without lowering the fatality advantage quantity.

The financial stability called for focuses on the ability to handle superior repayments easily, although IUL policies supply some flexibility.: IUL plans permit for flexible costs repayments, giving insurance holders some freedom on just how much and when they pay within established limitations. In spite of this flexibility, regular and appropriate financing is important to keep the plan in good standing.: Insurance holders must have a stable revenue or enough cost savings to ensure they can meet exceptional needs gradually.

Indexed Universal Life Plans

You can select to pay this rate of interest as you go or have the interest roll up within the policy. If you never ever repay the loan during your life time, the fatality advantages will be decreased by the amount of the outstanding loan. It indicates your recipients will certainly receive a lower quantity so you may desire to consider this prior to taking a plan finance.

It's important to check your cash value balance and make any type of required modifications to prevent a plan lapse. Life policy forecasts are a crucial device for recognizing the possible performance of an IUL plan. These estimates are based upon the forecasted passion rates, costs, settlements, caps, involvement price, rate of interest used, and financings.

Latest Posts

Index Universal Life Insurance Tax Free

Iul Life Insurance Pros And Cons

Cost Of Insurance Universal Life